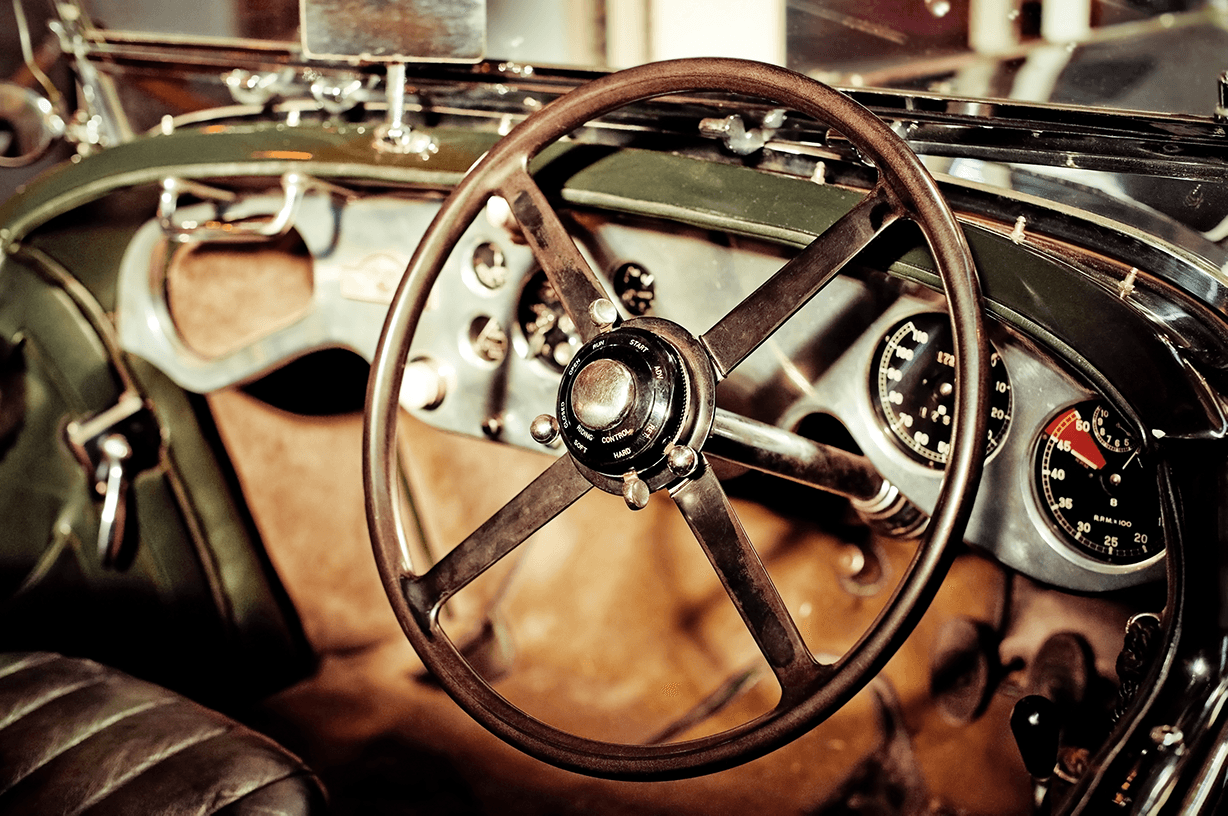

Specialist Motor Insurance For Unique Vehicles

Some vehicles are different, and so are we. Whether you own a classic car, campervan, kit car or custom build, we’ll help you find insurance that reflects what your vehicle really is.

As an independent broker, we work with a panel of specialist insurers and explain your options clearly. You’ll get cover that fits your vehicle, how you use it and what it’s worth.

Who this suits

We arrange specialist motor insurance for:

Kit cars and self-built vehicles

Motorhomes and campervans

Trikes, quad bikes and three-wheelers

Horseboxes and agricultural-style conversions

Specialist or unusual vehicles

Multi-vehicle or mixed-vehicle households

Swipe left or right to see more ➡️

What your policy can include

Every specialist vehicle is different. We’ll find insurers who understand how your vehicle is built and how you use it.

Core protection

Included on most policies, depending on the insurer and level of cover chosen.Optional extras

(We’ll explain what’s worth adding based on your vehicle.)Some high-value, imported or heavily modified vehicles may need additional insurer approval. We’ll manage this for you and keep you informed throughout.

Levels of cover, what’s included

Use this table to compare the main differences between cover levels. Features and limits vary by insurer, we’ll confirm exactly what applies to your policy.

On mobile, tap a cover level below to compare what’s covered.

| Feature | Third Party Only (TPO) | Third Party, Fire & Theft (TPFT) | Comprehensive |

|---|---|---|---|

| Damage or injury to other people or their property | |||

| Fire damage to your vehicle | |||

| Theft of your vehicle | |||

| Damage caused by attempted theft | |||

| Accidental damage to your own vehicle | |||

| Windscreen or glass cover | |||

| Cover for approved modifications |

* Subject to insurer terms, approval and policy limits.

- Damage or injury to other people or their property

- Fire damage to your vehicle

- Theft of your vehicle

- Damage caused by attempted theft

- Accidental damage to your own vehicle

- Windscreen or glass cover

- Cover for approved modifications

- Damage or injury to other people or their property

- Fire damage to your vehicle

- Theft of your vehicle

- Damage caused by attempted theft

- Accidental damage to your own vehicle

- Windscreen or glass cover

- Cover for approved modifications

- Damage or injury to other people or their property

- Fire damage to your vehicle

- Theft of your vehicle

- Damage caused by attempted theft

- Accidental damage to your own vehicle

- Windscreen or glass cover

- Cover for approved modifications

* Subject to insurer terms, approval and policy limits.

How it works

-

Step 1 of 4

Tell us about your vehicle Where it’s kept, how it’s built and how you use it.

-

Step 2 of 4

We compare insurers We review options from specialist insurers that suit your vehicle.

-

Step 3 of 4

You review the quotes We explain what each one includes so you can choose with confidence.

-

Step 4 of 4

We arrange your policy When you’re ready, we set it up and handle the paperwork.

We’re here at renewal, and if you ever need help with a claim.

Why use a broker?

-

We work for you, not the insurers

-

We use a panel of insurers who understand niche and collector vehicles

-

We know what underwriters need, including valuations, photos and build details

-

You get real people in Jersey, Guernsey and Alderney when you need support