CLIMATE CHANGE IS AN INSURANCE RISK

No matter what the preferred definition of RISK is when it comes to insurance, we have to agree on elements of uncertainty and unpredictability – even danger. Considering everything we know about natural disasters it is unthinkable to say that climate change isn’t an insurance risk.

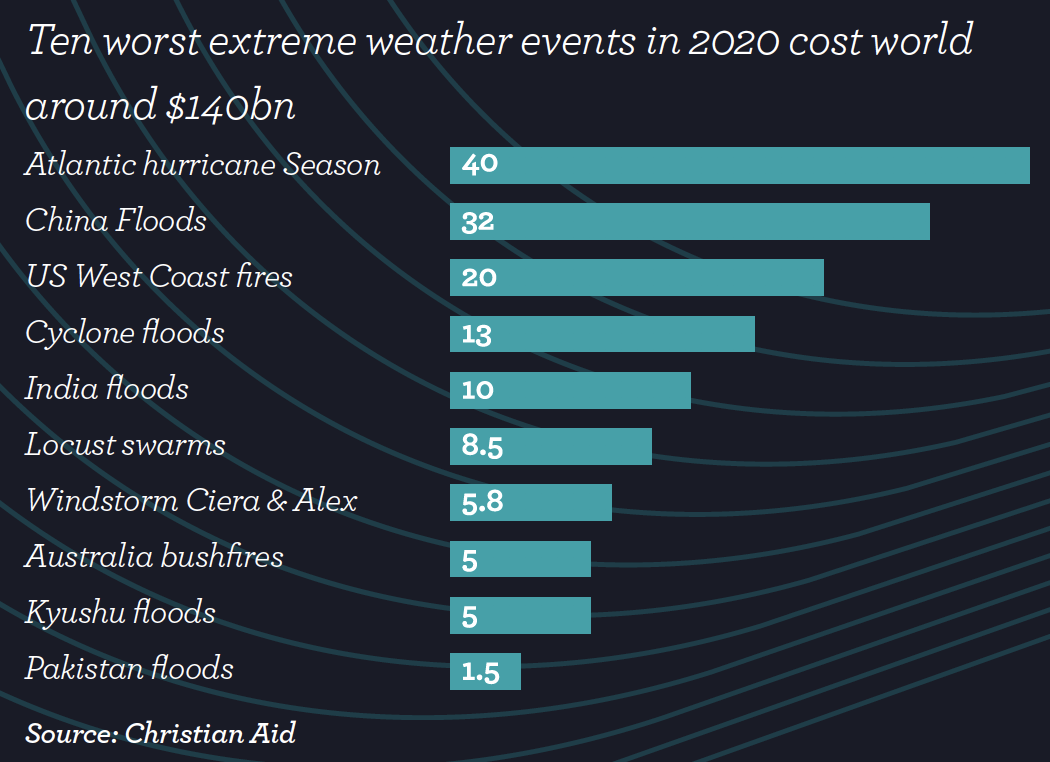

RECENT COSTS OF EXTREME WEATHER DISASTERS

Ten worst extreme weather events in 2020 cost the world around $140bn.

MODELLING ADJUSTMENTS NEEDED

The prevailing commentary in the market right now is that the models we have used historically, and everything we know about losses will not sufficiently guide us in the future. Climate change brings unpredictability. Our modelling needs to correct accordingly.

CLIMATE CHANGE AND THE MARKET ECO-SYSTEM

From tech centres in Silicon Valley to manufacturers in SE Asia and Banks across Europe, everyone is aligning their business strategies with climate change. This is attributed to how changing climate, storms, floods and regulated change away from fossil fuels towards low carbon energy will impact the supply chain, energy needs and ultimate profitability. Changing business needs have new risk needs to take into account.

New York Times via Independent.co.uk

EXAMPLE OF AN INSURER’S REACTION

On 14 January 2021, Business Insurance reported the following:

“Allianz has revealed concrete interim targets for reducing greenhouse gas emissions in its investment portfolio of policyholder funds.”

CLIMATE CHANGE AND PROFIT

For the first time in the recent history of the world, the profitability tables have turned. It is starting to become evident that solving the world’s climate change problems are more profitable than creating them. This will have new and untested risk factors to consider along the way.

Contacts:

Rickardt de Beer | Business Development Executive T: 01481 738036 E: Rickardt.DeBeer@islands.gg

William Woodford | Sales Director T: 01481 738040 E: Will.Woodford@islands.gg